Is Washington Fighting The Wrong Economic War?

While unemployment remains stubbornly high, Washington is spending its time fighting over the budget deficit

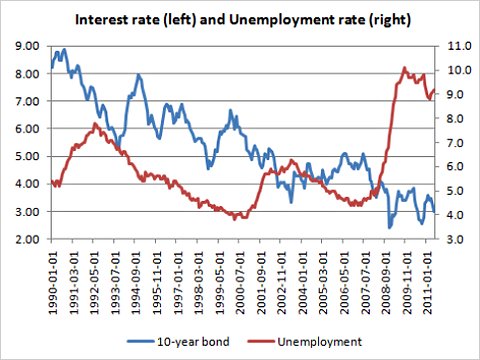

Paul Krugman shares this chart of interest rates v. the unemployment rate:

Steve Benen comments:

In case it’s a little hard to see, that red line is the unemployment rate; the blue line is the interest rate on 10-year bonds. I realize the phrase “interest rate on 10-year bonds” probably isn’t one of those phrases that gets bandied about around American dinner tables, but the more serious a problem the deficit becomes, the higher that blue line would appear.

And therein lies the point: the blue keeps going down. Indeed, it hasn’t been this low in many decades. If the deficit were a drag on the economy, and the United States were facing some sort of debt crisis, that blue line would be through the roof. But that’s not even close to what’s happening.

Instead, we have that red line to contend with, which translates to a jobs crisis.

The only topic of conversation in Washington right now is a debt-reduction deal, which intends to address that blue line. But there’s no need to address the problem that doesn’t exist. There’s a critical need to address the problem that does — the red line — but thanks to GOP gains and the Republican majority in the House — there’s no political will to do so. On the contrary, Republicans have said if Democrats don’t agree to massive debt reduction — i.e., taking more money out of the economy when it needs the opposite — the GOP will crash the economy on purpose.

Right off the bat, Benen and Krugman both miss a point about the deficit by concentrating solely on current T-Bill interest rates. If we wait until interest rates start to rise to deal with the structural deficit, then its likely to be both much more expensive and too late. Former Fed Governor Laurence Lindsey explained a few weeks ago in The Wall Street Journal why dealing with the deficit now is important:

First, a normalization of interest rates would upend any budgetary deal if and when one should occur. At present, the average cost of Treasury borrowing is 2.5%. The average over the last two decades was 5.7%. Should we ramp up to the higher number, annual interest expenses would be roughly $420 billion higher in 2014 and $700 billion higher in 2020.

The 10-year rise in interest expense would be $4.9 trillion higher under “normalized” rates than under the current cost of borrowing. Compare that to the $2 trillion estimate of what the current talks about long-term deficit reduction may produce, and it becomes obvious that the gains from the current deficit-reduction efforts could be wiped out by normalization in the bond market.

(…)

The second reason for concern is that official growth forecasts are much higher than what the academic consensus believes we should expect after a financial crisis. That consensus holds that economies tend to return to trend growth of about 2.5%, without ever recapturing what was lost in the downturn.

But the president’s budget of February 2011 projects economic growth of 4% in 2012, 4.5% in 2013, and 4.2% in 2014. That budget also estimates that the 10-year budget cost of missing the growth estimate by just one point for one year is $750 billion. So, if we just grow at trend those three years, we will miss the president’s forecast by a cumulative 5.2 percentage points and—using the numbers provided in his budget—incur additional debt of $4 trillion. That is the equivalent of all of the 10-year savings in Congressman Paul Ryan’s budget, passed by the House in April, or in the Bowles-Simpson budget plan.

Third, it is increasingly clear that the long-run cost estimates of ObamaCare were well short of the mark because of the incentive that employers will have under that plan to end private coverage and put employees on the public system. Health and Human Services Secretary Kathleen Sebelius has already issued 1,400 waivers from the act’s regulations for employers as large as McDonald’s to stop them from dumping their employees’ coverage.

But a recent McKinsey survey, for example, found that 30% of employers with plans will likely take advantage of the system, with half of the more knowledgeable ones planning to do so. If this survey proves correct, the extra bill for taxpayers would be roughly $74 billion in 2014 rising to $85 billion in 2019, thanks to the subsidies provided to individuals and families purchasing coverage in the government’s insurance exchanges.

Waiting until after interest rates start to go up to deal with the deficit, then, would be the equivalent of installing a sprinkler system after the building as already engulfed in flames. Too little, too late. We are in the very fortunate position right now of having historically low interest rates, but that’s not going to last forever. When that period ends, the cost of borrowing and the cost of simply maintaining the public debt will increase astronomically, and the chances of being able to pull together a deal at that point are slim to none. Either Krguman and Benan don’t recognize this or they don’t particularly care, which is it?

The most likely answer is the second one, because Krguman is clearly among those people who thinks that the answer to our current economic troubles is more spending, even though there’s absolutely no evidence that the last round of stimulus did anything at all to invigorate the economy. From an economic point of view its clear that more spending isn’t the answer to our problem:

Since 2008, we’ve had a rather lengthy experiment in elevated federal spending intended to address unemployment. Yet, our current unemployment rate is even higher than what the Obama Administration said would have happened in the absence of “stimulus,” let alone where it promised the unemployment rate would be.

Of course, the Krugman school of faith-based economics has a response: the “stimulus” package was never big enough in the first place. This is a very convenient argument since it is non-falsifiable. No matter how many trillions of new T-Bills we print with no effect at all on the unemployment rate (because the lack of available cash isn’t the reason that businesses are reluctant to hire), the Krugmans of the world can always claim that at some magical point of just a little more it would have worked. Then they can just keep pointing fingers for the failure of their own undertheorized economic theory.

At the same time, I think there’s some truth to the observation that Washington is ignoring the economic forest for the trees. In the minds of most Americans, the biggest issue isn’t what happens to the budget deficits, but what happens to jobs and the economy. Right now, neither party seems to be addressing those concerns very well. In yesterday’s post about the June jobs report, I made this observation:

We’ve known since November that voters top concern during the mid-term elections was jobs, jobs, jobs. Somehow, though, the conversation in Washington has turned to austerity and spending cuts. If you listen to Republicans on television, they keep repeating the line that getting government spending under control will create jobs, but I’ve never quite understood where the logic in that argument comes from. If the government spends less, how, exactly does that lead to a stronger economy? How does it put money in the hands of businesses that they’d be willing to use to expand, develop new lines of business, and hire new workers? Moreover, if spending cuts lead to government workers losing their jobs, doesn’t that mean unemployment is going to go up, at least in the short term?

Reducing uncertainty over the debt ceiling and government spending will no doubt reduce general business uncertainty, and that will likely help stimulate growth to some degree, but there’s a lot more that Washington can do to help stimulate the economy. There are changes in tax policy, reducing regulations, and a whole host of other policy changes that could be made that will help in that regard. But none of that is even being discussed right now, and its unlikely to even be considered until the debt deal is completed. Politically, though, I’m not sure that this is the smartest thing for either party to be doing. Frustration with Congress is already high, and it’s only likely to get higher if the public starts to think that Washington isn’t addressing the problems that concern them the most.

So, in your opinion, reducing government spending is unlikely to create jobs (and is in fact likely to lead to higher unemployment), but Paul Krugman is wrong that further economic stimulus would have a positive impact on jobs and the economy because…okay, I think you’ve lost me here.

It’s little surprise that the stimulus wasn’t a magical cure-all for our nation’s economic woes when you consider that it was largely offset by huge contractionary measures at the local and state levels. Indeed, as the stimulus winds down, it is glaringly obvious that it is austerity and not stimulus that has not worked. People like Krugman and Benen have been making this point for quite some time, and the line of reasoning you use to dismiss them strikes me as nonsensical.

@Aidan:

I went back and added a link about the rather obvious fact that the stimulus failed, I suggest you take a look at it. My point is that there are things that can be done by Congress that would stimulate the economy that don’t involve spending money we don’t have on another boondoggle stimulus plan. What’s glaring about people like Krugman and Benan is that they fail to even acknowledge the fact that there we cannot afford to do what they are advocating.

Of course, it’s rather irrelevant. The political case for additional stimulus is dead, even the Democrats don’t believe that nonsense anymore.

Apart from reducing taxes and regulations (both done during the Bush era…worked well, eh?) what else would you suggest?

Well yes, of course. It led to a golden age. Everything was perfect until Obama came along…

How childish…or libertarian of you Doug.

Same thing really.

There is billions of dollars in economic stimulus in next year’s budget.

You say the stimulus “failed” but the reports you cite to show that the stimulus created jobs. Also, you must factor job losses that were averted due to it, which obviously is inherently difficult to determine.

You link to a Wall Street Journal op-ed that cites to a McKinsey study that they have admitted has no predictive value. I mean, that’s pretty worthless analysis if you are relying on such a study to make a determination about the future.

Have you considered that making huge spending cuts will lower aggregate demand, slowing economic recovery, thus making the deficit worse due to lower tax revenue and continued strained on government social spending? The best way to get the deficit under control is to get our economy growing again. All data indicates that decreased government spending will suck money out of the economy further dragging our economy down. Nothing you cite says the stimulus failed.

No economic model has ever accounted for “uncertainty” which is a concept conservatives made up because they wanted to stop the Democrats from engaging in Keynesian fiscal policy. Ironically, during the last recession, Republicans openly relied on Keynesian theories to support the Bush tax cuts. Funny, how that goes down the memory hole immediately…

Nothing you cite says the stimulus did not create jobs. It simply cites a bunch of competing arguments about the number of jobs, how to measure such things, and the cost-effectiveness of it. That’s a wholly separate argument than saying it failed. That’s just a broad assertion by you, backed up by some funny ideas about the economy no one heard of until 2009.

Considering the failure of supply side economics to accurately describe the world, economic ideas created during politically opportune times by Republicans should be taken with a grain salt barring rigorous debate and application to the real world.

Well, spending several hundred thousand dollars per job while the economy continued to flounder and people went unemployed doesn’t sound like good policy to me

So what would be good policy? Tax cuts and deregulation? If not those, than what else…

You cite some guy at the Moderate Voice who, from what I can tell, isn’t even an economist, for support that the stimulus didn’t work? Man, you’re just flailing. For your own sake, stick to legal analysis. By the way, one of Krugman’s points is that people (such as you, apparently) have been moaning about the imminent skyrocketing of rates for … 3 years now? It may happen, but most likely because Republican’s force the US into default. And the cost of the last stimulus? Piddling in comparison to the size of the US economy and easily paid off. What has not been easily dealt with are the Bush tax cuts and 2 unfunded wars. Conservatives are the practical people … yahhh, sure.

I’m not convinced that Logan Penza is familiar with the ideas of Keynes or an introductory economics course. Talk about unlearning the lessons of the 1930s.

Most of the conservative/libertarian cases against stimulus that I’ve read seem to come partially from the belief that the government has no business trying to boost employment even when the remedy isn’t coming from the private sector. You don’t seem to share this belief, Doug – you just seem to believe that lowering taxes and getting rid of regulations will magically spur economic growth. The past two decades have left me with the impression that the employer response to changes in marginal tax rates matters much, much less than conservative economics seem to assume. The Great Depression and Japan’s lost decade leave me with the impression that it is insane and cruel to throw up our hands and pretend that either the government has done all it can or that the government has no legitimate capacity to exercise the tools at its disposal.

Stimulus eh. One part tax cuts (not the same as Keynesian spending plan) one part shoring up state government budget holes (again not really an increase in spending but rather maintaining a status quo) and one part actual stimulus, much of which has not been spent.

It’s fine to argue that stimulus won’t work, but rather disingenuous to argue that our ‘big stimulus’ proves your point as that it was nothing of the sort. What did we get like 80 billion of actual stimulus spending and you are surprised it didn’t buoy this sinking ship?

@Doug Mataconis: “Well, spending several hundred thousand dollars per job while the economy continued to flounder and people went unemployed doesn’t sound like good policy to me”

I don’t understand what your policy alternative is. Rarely does a government policy perfectly attain the goals it set outs to do. That’s true for most human endeavors. Is the alternative to stop trying to create jobs, because any measure probably will not produce 4% employment? Or is it that the government should do nothing to fight unemployment because any predictions about the scope of the problem are not going to be a 100% reliable?

I actually would support just helicopter dropping money into the economy, as your comments suggest you think it would be more effective. I agree! Give everyone a check for a couple of thousand of dollars. The political obstacles to such a policy are pretty formidable to such a policy.

The point remains: decreasing aggregate demand has been shown to hurt economic growth. That’s been shown pretty conclusively as local government has laid off large numbers of people throughout this recession dragging employment and economic growth downward.

http://thinkprogress.org/romm/2011/07/09/264294/government-investment-in-innovation-is-needed-to-overcome-the-%E2%80%9Cvalley-of-death%E2%80%9D/

Here is a recent post from Climate Progress, mentioning a study which found that “the Human Genome Project cost $3.8 billion, but created over 310,000 jobs and drove economic growth of almost $800 billion. That government boost spurred a wave of private investment, causing a precipitous drop in the cost of genome decoding.”

Perhaps you can send this along to Logan Penza of The Moderate Voice, who apparently cannot believe that spending money will result in jobs.

Again with that Weakly Standard crap? Aren’t they still claiming WMD were found in Iraq? They think fossil fuels are a renewable resource. It’s your website but I’d like to see discussions based on credible sources.

Well we’ve been trying tax cuts for the rich for years on the basis of never-proven trick-down theory, so why not try stimulus spending for a bit more than 3 years?

Going after the deficit now, when it isn’t a crisis and unemployment is, is like invading Iraq before we shored up Afghanistan. It’s a diversion that just makes it harder to deal with the immediate problem.

Long term unemployment destroys families, it destroys careers, it destroys communities.

Interest rates are basically 0%. No one is worried about the long term prospects of investing in American bonds. We should be running a deficit while we get the job market back on track.

Increase demand — put money into the hands of people who will spend it, by increasing the duration of unemployment insurance, and the monthly payouts. Tax cuts for the wealthy just puts money in the hands of people who will save it.

And, now is the time to actually do all the deferred maintenance on our infrastructure — paint roofs white, replace sewer lines, fill in potholes, etc. It saves us money in the long run, as the longer we defer fixing things the more expensive it gets, and it helps stimulate the economy.

The deficit can wait for a couple of years. A bustling job market will actually help create more revenue.

We have a huge infrastructure deficit in our country, have the ability to borrow money at extraordinarily low rates, and have 9.2% unemployment.

I’ve heard we can’t pursue expansionary monetary policy because it will lead to hyperinflation. That dog hasn’t barked. I’ve heard we can’t pursue expansionary fiscal policy because interest rates will explode. That dog hasn’t barked. When are we going to admit that the Keynesians had it right? What are our other options besides resigning ourselves to economic fatalism?

Haha, I saw that, too.

They think depleted oil wells are magically refilling.

@Doug Mataconis: Of course we can afford it. We merely have to raise some taxes. This isn’t a religious issue, Doug, and just because people on the right have decided that raising taxes is a moral sin doesn’t make that the truth. We are a rich country, but unfortunately the Republicans have decided that all our wealth belongs in the hands of a few thousand people.

@Doug Mataconis: You’re right. They should have taken the ridiculous tax cuts out of the stimulus and spent that money putting people back to work.

It seems odd to argue Krugman’s call for larger stimulus is somehow “faith-based”. We have strong empirical evidence stimulus works when supplied properly, namely World War II.

The problems with the Recovery Act were numerous. $300 billion of it was in the form of tax cuts, which do little to spur new spending when people are worried about jobs and bankruptcy. Massive budget cuts at the state and local levels almost completely nullified the remaining $500 billion; in effect there was no net increase in spending to stimulate the private sector itself. Also, Krugman and others pointed out the structure of the stimulus was not optimal. What makes stimulus effective is not the amount you spend over a period of time, it’s the rate you spend at a given moment. In other words a massive flood of spending over a period of a year or less would have been much more effective than the Recovery Act we got which spread spending over a couple of years.

The administration effectively crafted a stimulus which was too weak, with too many tax cuts, spread out over too long a period. The results were heavily attenuated and many people, again including Krugman, warned it would be better to do nothing than enact a stimulus program too weak to deliver serious medicine.

It´s more complicated. The problem is not that deficit reduction creates jobs, but that deficit spending has the potential to destroy jobs. There is interest rates to be paid on debt and when people are buying Treasure bonds they aren´t investing money on production and in the economy.

And, unless Republicans accept to raise taxes and Democrats accept cuts to spending, there is no War on Deficits in Washington. Specially considering all demagoguery regarding Medicare by Republicans in 2009.

@André Kenji de Sousa:

But people choose to buy T-bills. They aren’t required to do so simply because the government offers them for sale. The reason yields on the debt are so low is because a lot of people don’t want to invest privately. They see the current risks as unacceptable and want to lock in a safe, albeit low return investment.

We’re also confronted with an oversupply of capital chasing too few investment opportunities. This is why so much money was tied up in, and lost, to instruments like subprime loans and credit default swaps. Capitalism has done exactly what was expected of it, generating tremendous quantities of capital concentrated in a relatively small number of hands, a level far in excess of what could be reinvested into healthy, productive activities which also generate strong returns (first postulated by Marx).

This is also why I’ve come to believe inequality damages economic growth. Had that capital found its way into the hands of the vast middle class rather than become concentrated in the hands of a few people who had nothing else they could do other than invest it, far more of it would have been spent, generating real growth and avoiding the investment glut.

Having no where else to go, this excess capital incentivized the development of increasingly risky financial derivatives which, while generating massive returns, were thoroughly unproductive and ultimately had the effect of destroying more wealth than they created. So severe has this “internal contradiction” inherent within capitalism become that monetary policies of any form have become ineffective in combating recession.

P.S. No, I am not a Marxist in the conventional sense. I simply find some of Marx’s insights (which were considerable once you strip out his inflamatory rhetoric) into the inherent weaknesses of our economic system useful for at the very least determining how and where our current problems have developed. I believe capitalism and the free market have become so completely confused and conflated with one another that many assume they have the same strengths and virtues. Although I do accept to a certain degree that markets cannot “fail” in a fully transparent system, capitalism can as it values “capital” above all other primary factors of production in all circumstances.

Roosevelt’s recovery started long before WWII.

Here’s % GDP growth while he was in office:

1933 -1·3

1934 10·9

1935 8·9

1936 13.0

1937 5.1

1938 -3·4

1939 8.1

1940 8.8

1941 17·1

1942 18.5

1943 16·4

1944 8.1

1945 -1.1

To appease the Republicans, he cut back many of his programs in 1938 with obvious results.

WWII didn’t really start for America until 1942.

To be honest Doug, I think you’ve given us a shallow, politicized, and immoderate view.

The easiest ways to show that are look for the cheats. The most glaring is to answer a fact (low interest rates) with a what-if (they might not be low someday). After all, they might not. I actually read an interesting investment piece this week on why they might not. The analyst asked to what extent governments really “set” low rates? We know it only works sometimes. The Greeks are having trouble with it now. He asks why so many countries, not just the US, are able to get away with it. His somewhat worrying (for the investor) answer is that the savings glut isn’t over, and that the giant pool of money is still out there. If that’s true, 10 treasuries will stay low just because too many people want to buy them.

I think the second cheat is to look at stimulus with a success-fail dichotomy, with fail carefully defined. We know that the stimuli helped, in various, moderate, ways. Look at the deflection in the case-shiller housing price curve, for instance. No, we did not have the screaming success of restored house prices, but the precipitous decline (the Panic) was clearly caught, and a more measured (and one hopes more rational) adjustment continues. (Beware what-if’s here, some as would-be Nostradamus tells us they’ll fall just as far as they would in Panic.)

As I’ve said in the past, I think congress and the president split the difference with stimulus and did “about half a krugman.” They got something for that. The reasonable debate should be about “at what cost” and not these crazy “it did nothing” or “it failed” strawmen.

I could go into what might be moderate responses going forward, but as I’ve also said before, I don’t think it matters. The public just seems to have had enough with stimulus, and is not at all ready to reverse for a full-krugman. I get that on a gut level.

The thing people may not understand though, is that pulling back to something more like austerity isn’t going to be all sunshine and puppies.

With reduced aggregate demand and reduced government spending, it will be a slow slog toward recovery. In fact, I think it depends on counting time until the next tech revolution. We need another internet …

The problem conservatives have is that when people middle-and-left make only a moderate claim, like “stimulus helped” they are forced into a very immoderate position, if they want to disagree at all. At that point they have to say “no stimulus did not help at all.”

That’s crazy, and miles and miles away from the similarly extreme “the stimulus was perfect” argument. You know, the one nobody is actually making.

The answer to your title is: yes.

It would be nice for you to even once abandon your ideology to actually see the real world.

I suppose it is out of the question, since reality shows what a sham your beliefs actually are.

Felix Salmon brings the economics

I have seen half a dozen empirical studies that found that the ARRA did not stimulate the economy and no empirical studies that found that it did. The reports from the CBO, Macroeconomic Advisors, and Moody’s/Blinder usually cited in support of the ARRA aren’t empirical: they merely plug the size of the stimulus into the same models they used to determine how large the ARRA needed to be and found that, in theory, the economy should have been stimulated. Hence my view that a properly timed and constructed stimulus package can produce economic growth but that the ARRA was neither properly timed nor constructed.

The retort to this has been “How can you spend $800 billion and it not stimulate the economy?”. The response to this is that additional federal spending won’t produce $800 billion of stimulus let alone $1.6 trillion or more of stimulus if it’s saved or offset by reductions in borrowing by state and local governments which seems to be the case. Did the ARRA produce some stimulus? Probably. How much? I have no idea. Clearly not enough due to its poor construction.

I wish we were debating whether Congress is capable of producing a bill or package of bills that can stimulate the economy and produce jobs rather than Keynesian theory. I accept the theory. I’m not as sure that the Christmas tree approach that Congress takes will produce a bill that implements it effectively.

Wonderful to pretend that the Great Recession just sort of happened by magic and that the remedies attempted are obvious total failures because we haven’t achieved prosperity. In fact, the conservative ‘remedies’ are responsible for the almost-complete destruction of the financial industry of the ENTIRE FRIGGING WORLD. Just to keep the issue in perspective, what happened in ’08 was that something like $14 Trillion just disappeared. People like you & me had looked at accounts that they thought they owned and counted their money and — collectively — thought they had trillions and trillions of dollars more than they have today. But conservatives blame Barack. Very perceptive.

The problem you have in your first paragraph, Dave, is that everybody who calculates an ARRA impact compares it to a manufactured counterfactual(*).

The problem you have in your second paragraph is that you changed the question half-way through. You lost your counterfactual. What would total government spending have been, absent ARRA? Higher, or lower?

It boggles my mind that anyone would think spending with the right hand “failed” because spending with the right hand slowed.

* = (There was one study that asserted they had found truly equal regions that differed in stimulus received, and that the delta in jobs between them could be taken purely as a stimulus measure, but I think we can see how that could be equally wrong. Miss one difference between regions and the comparison is shot.)

heh, two right hands.

It’s incredibly disheartening to see a conservative who is obviously an intelligent, educated, and plugged-in person of good will, fall for this kind of preposterous claptrap, and to cite such unqualified and thoroughly discredited sources as though they had any kind of factual basis. I would hope you’d be a little bit embarrassed, Mr. Mataconis.

One expects this kind of thing from GOP operatives pushing the sabotage of the economy for the political and economic benefit of their benefactors, but I try to read OTB because generally you present a rational, non-batshit loony argument for the conservative world view, which is often enlightening and interesting, and sometimes convincing.

And now this. tsk.

“But people choose to buy T-bills. They aren’t required to do so simply because the government offers them for sale. The reason yields on the debt are so low is because a lot of people don’t want to invest privately. ”

There aren´t many people buying Treasure Bonds. The ones that are buying them are central banks of countries like China and Japan, that wants the US Dollar to be more expensive. That would change if these artificial low interest rates were to rise(And they will) and many people that are now buying stocks begins to buy bonds.

By the way, the “Celtic Tiger” show us how these situations can change very fast,

So André, how long have people been waiting for Japanese rates to rise?

(It’s funny that sometimes the same people who worry about the US “turning Japanese” will also worry about high interest rates on the horizon.)

@ponce: There’s no question the New Deal deficit spending helpd significantly in pulling the country out of the Great Depression, but in 1939 when defense spending began to surge unemployment was still 15%. By 1943 it was 1.9%. In four years the massive stimulus of WWII (over 40% GDP) reduced unemployment further than the far smaller stimulus of the New Deal Deal had in seven years.

Spending over a smaller period at a greater rate was more effective overall which, to me, is the lesson the administration should have taken to heart when constructing th Recovery Act.

I do have to chuckle at conservatives who like to sneer that “the New Deal didn’t fix the Depression, WWII did”.

Which perfectly captures the myth found in conservative circles that infrastructure spending is wasteful soshulizm, but military spending is somehow a “job creator”.

“contradiction” rather than “myth?”

“So André, how long have people been waiting for Japanese rates to rise?”

The United States is not Japan. The United States has a consumption, not a exporting economy, and very low saving rates.

Doug, I have a BA in economics. When you write:

All I can think of is this. If you don’t have a basic grasp of macro theory or how Keynesian policy works, don’t embarrass yourself writing about macro theory or how Keynesian policy works.

@André Kenji de Sousa, that is so weak.

Not only that they are shorter than us, and eat raw fish!

(Seriously, it you didn’t address the buyer-side of the bond equation. The japanese have their own savings glut, and had it before one appeared in america. But then america got one too, by way of emerging economies. As I say above, the rate question rides on whether the “giant pool of money” is still out there.)

America has no savings glut. Americans are too much indebted to spend. That´s pretty different. You can´t spend when you don´t have money.

André, “America has no savings glut” is a cheap distraction.

Either that or you really haven’t been following economic news. As the “pool of money” piece above throughly describes, it never was a domestec pool of money.

If you aren’t trying to distract, read up. If you are trying to distract, get off.

How a country that has almost ONE TRILLION of Credit card debt be facing a savings glut?

@André Kenji de Sousa: Because that debt is held by the middle class and poor. The wealthy are the ones with a vast pool of capital with no where to invest it all other than low-yield government debt financing or highly speculative financial derivatives.

André, the full sentence was:

It’s a global economy, and the emerging economy’s savings glut drove profligacy (good word) in many of the established market economies.

Example:

Brazil Becomes Net Creditor for First Time in January 2008

“It’s a global economy, and the emerging economy’s savings glut drove profligacy (good word) in many of the established market economies.”

I live in Brazil. I´m affraid that we´re suffering a credit bubble, not a savings glut.

“Because that debt is held by the middle class and poor. The wealthy are the ones with a vast pool of capital with no where to invest it all other than low-yield government debt financing or highly speculative financial derivatives. ”

Yes, that why there is a problem of low demand in the internal market in the US. But that´s not a savings glut problem.

The historic transition of emerging economies from net debtor to net creditor is one of the biggest stories of the new millennium. I’m not sure how Brazil has changed since its 2008 transition, but Brazil was not alone.

And there is an important flip side:

“Deleveraging” will dominate the rich world’s economies for years.

doug: “even though there’s absolutely no evidence that the last round of stimulus did anything at all to invigorate the economy. ”

As has been pointed out, the article contradicts you. Also, perhaps you haven’t noticed, but Krugman himself was criticizing the size and composition of it since it was a gleam in Obama’s eye.

The transitions of developing economies frai