Super-Majority Requirements and Fiscal Outcomes (Tax Compromise Edition)

The pending compromise between the two parties on taxes and other policies underscores the fact that enhanced minority power (in this case, the filibuster power) helps contribute to fiscal irresponsibility.

How Can Obama Be a Commie and Cut Taxes for the Rich?

Did Obama’s tax cut deal demolish the Republican charge that he’s a radical? Not hardly.

Tax Cuts and the Post Hoc Ergo Propter Hoc Fallacy

Minor fluctuation in tax rates is not the most significant thing happening in the world’s largest economy.

A Primary Challenge For Obama?

Even though it will likely be unsuccessful, a primary challenge against President Obama could end up harming him enough to hand Republicans the White House in 2012.

Obama Defends Tax Cut Deal As Democrats Signal Opposition

Amid signs that Democrats in Congress might rebel against the tax cut deal he struck with Republicans, President Obama took to the airwaves today to defend it at the same time that his base is rebelling against it.

Obama’s Tax Cut Compromise: Masterful Politics, Or A Fatal Cave-In?

President Obama is already taking heat from the left for his compromise on tax cut extensions, but will it actually hurt him in the end?

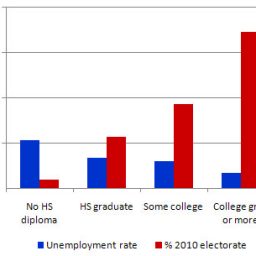

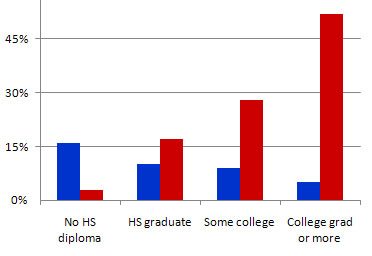

Unemployment, Education, and Voting

The unemployed are predominately poorly educated non-voters. Some argue that they are therefore getting far too little attention from the political class.

President Obama, GOP Reach Tax Cut Extension Deal

President Obama and the GOP have reached a deal on extending the Bush tax cuts that gives the GOP virtually everything it wanted.

Bush Tax Cut Extension Near

Republican maneuvering to extend the Bush tax cuts for all Americans appears about to pay off.

Why Democrats Are Losing The Tax Cut Debate

Democrats are losing the debate over the extension of the Bush tax cuts, but when you look at the playing field it seems pretty clear that that they never had a chance.

Line of the Day: Tax and Spend Edition

They aren’t going to stop, but the cliches that pass for debate sure are tiresome (plus some musings about the tax cut extension debate).

Senate Rejects Democratic Plans On Tax Cut Extension

The Senate rejected an effort to limit the extension of the Bush tax cuts based on income level. At this point, the only question is when Democrats will concede defeat on this debate.

Memo To Congress: It’s The Economy, Stupid

Today’s job numbers make it clear that Congress has only one duty, and that is to do everything it can to stimulate real economic growth.

The Failure of “Starve the Beast”

The Republican talking point that lowering taxes lowers spending and raising taxes increases spending is denied by reality.

The Real Deficit-Reduction Math

There is a simple mathematical equation that explains why deficit reduction is so difficult.

The GOP Dilemma: Tea Party Not Representative Of America As A Whole

According to a new poll, the Tea Party movement, which is largely now the base of the GOP, is not completely in step with the views of American voters as a whole.

Bush Tax Cuts On The Table In December, Public Backs Democratic Position

Congress will vote on extending the Bush Tax Cuts in December, and new polling shows that the public agrees with Democrats that the cuts should be limited to the “middle class.”

Defeated Senators, Arms Treaties, And Lame Duck Sessions

Unless there’s an emergency, is it proper for representatives who have been defeated in a mid-term election to be voting on controversial legislation?

Lame Duck Congresses And The Constitution

While not inherently unconstitutional, lame duck Congresses have the potential for violating the spirit of the Constitution and create the potential for mischief on the part of Representatives who have been thrown out of office.

Liberals, Tea Party Seem United In Ire For Debt Commission Proposal

The immediate reactions from left and right to the proposals from the Chairmen of the Debt Commission are about what you’d expect.

Republicans Still Not Getting Specific On Spending Cuts

They’ve won the elections, but Republicans still aren’t getting specific about exactly where they’d cut Federal spending.

Republicans Claim Victory, Obama Acknowledges “Shellacking”

Congressional Republicans and President Obama both held press conferences today that included talk of bipartisanship and working together. Don’t believe it.

GOP Victory/Tea Party Victory: Is There a Difference?

Ok, so we’ve been talking about the Tea Party for months. What will that label means once we actually have elections and move on to the governing bit?

The 112th Congress: A “Do Nothing Congress”?

Republicans are promising two years of gridlock and obstructionism if they take control of Congress, but is that really what the people who are likely to vote for them next week really want?

An Observation on the State of the Debate over Fiscal Policy

Instead of decades-old retreads like talking about abolishing the Department of Education, it would be nice if we had a real debate about the fiscal circumstances in the country.

Obama Cut Taxes? Really?

Remember that $400 tax cut President Obama gave you? Neither do 90 percent of Americans.

Taxing the Successful

High earners are going to have to pay more than our fair share of the costs of government to make things work. But how we frame the debate matters.

Carly Fiornia Won’t Say Where She’d Cut The Federal Budget

Yesterday’s appearance by Carly Fiorina on Fox News Sunday provided an excellent example of how un-serious Republicans are when it comes to living up to their fiscally conservative rhetoric.

More on Taxes and Incentives

More on Greg Mankiw’s thought experiment on taxes and incentives to work.

Taxes and Incentives

Greg Mankiw argues that, the more of his money the government takes, the less incentive he has to earn more. That’s debatable.