Alabama Wins 14th National Championship; Playoff Needed

There’s no perfect system for choosing a champion but we can do better than this.

There’s no perfect system for choosing a champion but we can do better than this.

Some initial data released today points to the possibility of a very position jobs report tomorrow, but don’t hold your breath.

Guess who got advance warning of government actions on the eve of the 2008 financial crisis?

“The debt crisis is burrowing ever deeper, like a worm, and is now reaching Germany.”

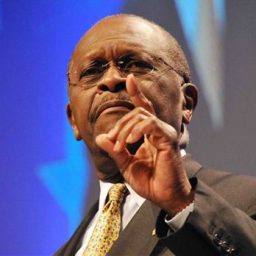

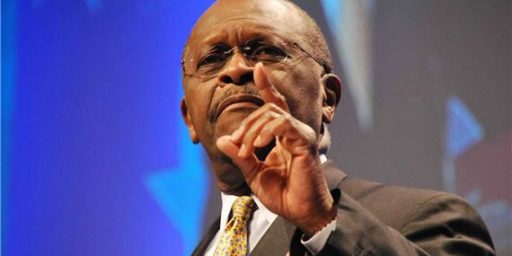

Herman Cain has either doubled down on his foreign policy ignorance or proven himself a man of great nuance.

The Associated Press is trying to fight Twitter rather than engage it.

Bob Knight coached Mike Krzyzewski at West Point. Now, Coach K has broken his mentor’s record for all-time victories as a head coach.

As if we needed another child rape scandal involving a famous institution of higher learning . . .

Michele Bachmann is looking for a few good staffers for the Granite State.

The BBC is reporting that rebels claim to have captured the ousted leader of Libya.

Robert Downey, Jr. goes out on a limb for Mel Gibson, returning a favor.

Herman Cain is leading Mitt Romney in two respected polls.

The Justice Department claims to have disrupted a major Iranian-backed terrorist attack in the United States.

We’re learning more about the Obama Administration’s decision to kill Anwar al-Awlaki

Texas is ending the time-honored tradition of allowing condemned men to pick their last meal before being put to death.